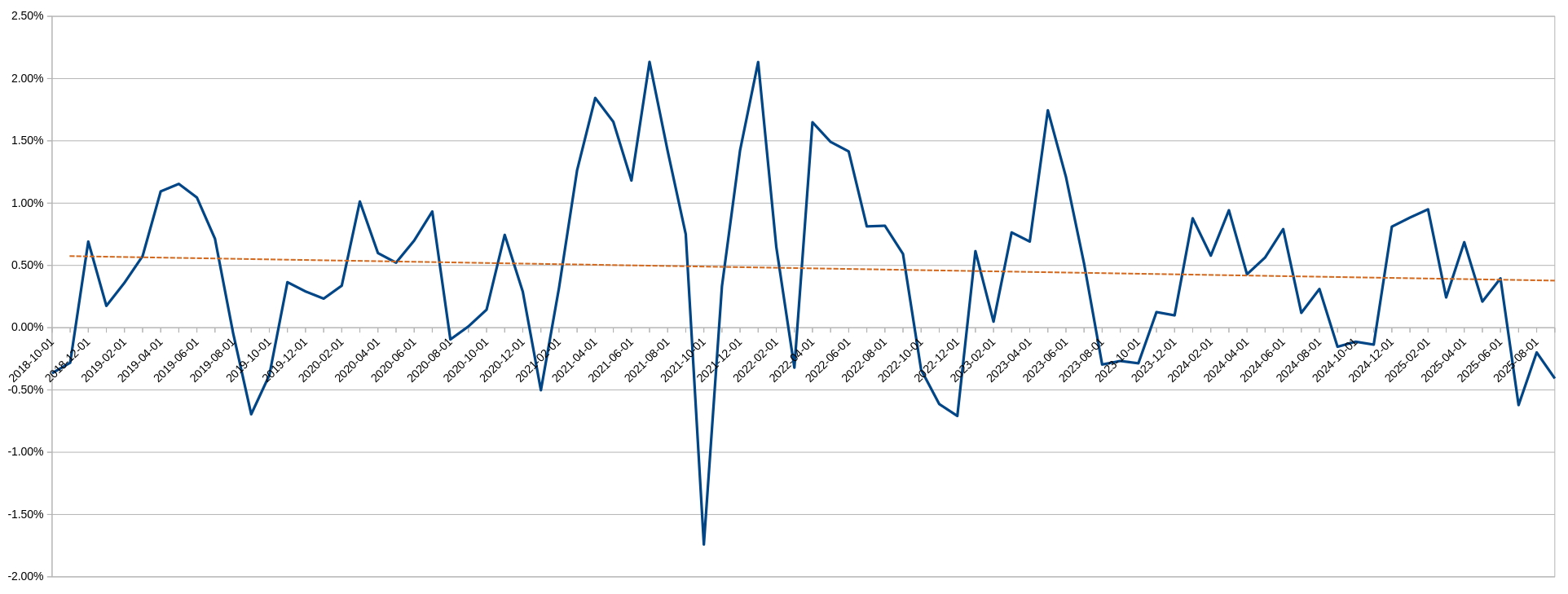

Data Point: 2025-11, The ZORI (Sept 2025)

Recent data (up through September 2025) demonstrates a softening of rent growths. Rents increased 3% in 2024 - 2025 after a growth of 4% in 2023 - 2024 and a growth of 3% in 2022 - 2023; this is significant decline in growth from the inflationary years of 2020 - 2022 with growth rates of 12% and 10% respectively.

| Year | 2015-09 | 2016-09 | 2017-09 | 2018-09 | 2019-09 | 2020-09 | 2021-09 | 2022-09 | 2023-09 | 2024-09 | 2025-09 |

|---|---|---|---|---|---|---|---|---|---|---|---|

| Rent | $891 | $960 | $1,036 | $1,081 | $1,129 | $1,182 | $1,321 | $1,448 | $1,497 | $1,562 | $1,606 |

| Increase $ | - | +$69 | +$76 | +$45 | +$48 | +$53 | +$139 | +$127 | +$49 | +$65 | +$44 |

| Increase % | - | +8% | +8% | +4% | +4% | +5% | +12% | +10% | +3% | +4% | +3% |

% Change |

Rents |

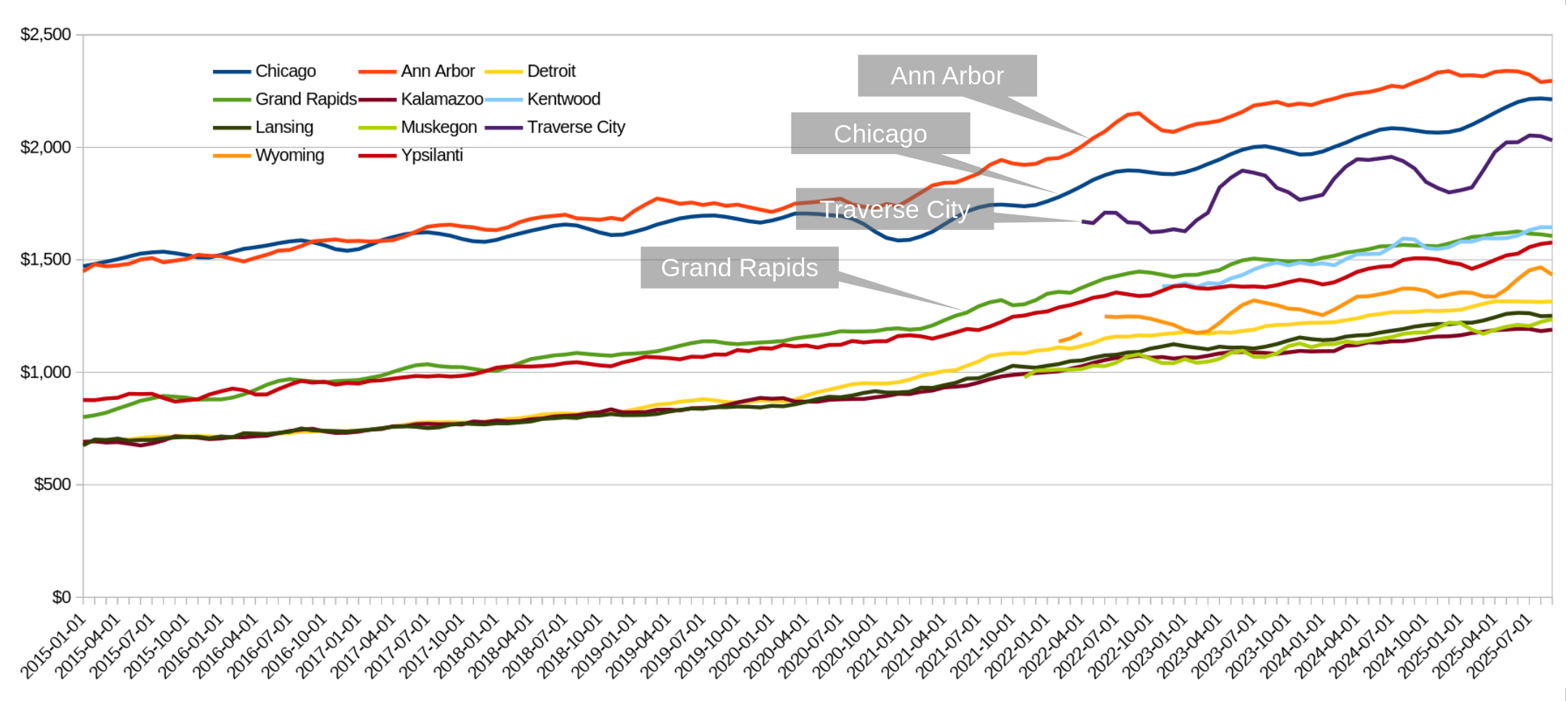

There is a narrative circulating that the prices have flattened regionally, particularly that rents in Grand Rapids are now equivalent to rents in Chicago. So what affordability advantage does Grand Rapids offer relative to the lack of urban amenities such as passenger rail and an extensive bike lane network? Like many narratives, this one is false. Chicago rents are ~38% higher than rents in Grand Rapids, with a difference of ~$600/mo. Grand Rapids still provides a significant affordability advantage; the difference relative to the available amenities and/or wages is left up to the reader to determine for themselves.

| City | Chicago | Ann Arbor | Detroit | Kalamazoo | Lansing | Muskegon | Traverse City | Ypsilanti |

|---|---|---|---|---|---|---|---|---|

| Rent | $2,213 | $2,296 | $1,315 | $1,189 | $1,251 | $1,236 | $2,031 | $1,577 |

| GR +/- | +$607 | +$690 | -$291 | -$417 | -$356 | -$370 | $425 | -$30 |

| GR %+/- | +38% | +43% | -18% | -26% | -22% | -23% | +26% | -2% |

Note: The median household income of Chicago (~$75K/yr) is ~13% higher than the median household income of Grand Rapids (~$65K/yr). This is a rough monthly difference of $833/mo gross income. Full counter sales tax in Chicago is a minimum of 10.25% relative to Grand Rapids' 6.0%. The city of Chicago has a flat income tax of 4.95%, while the city of Grand Rapids has a flat income tax of 1.5% on top of the Michigan income tax rate of 4.25%.

Regional |

What is the zORI? It is the Zillow Observed Rent Index. A smoothed measure of the typical observed market rate rent across a given region. ZORI is a repeat-rent index that is weighted to the rental housing stock to ensure representativeness across the entire market, not just those homes currently listed for-rent. The index is dollar-denominated by computing the mean of listed rents that fall into the 35th to 65th percentile range for all homes and apartments in a given region, which is weighted to reflect the rental housing stock. You can find the details of the methodology 👉here👈,

Related

- Data Point: ZORI 2025-06 (City vs. MSA), UrbanGR

- Affordability Tables 2025, UrbanGR

- H+T Index, Center for Neighborhood Technology (CNT)

- Cost of vehicle ownership, Nerdwallet

- Zillow Research Data, Zillow

- A Look At The UZA, UrbanGR

- Data Point: zORI In 2024 (Midwest), UrbanGR